Advertisements

The HDFC ForexPlus Card has quickly become one of the most reliable travel companions for anyone planning an international trip in 2025. In a world where global mobility is essential, whether for business, education, or leisure this prepaid foreign currency card offers a smart and secure way to handle your money abroad.

Instead of juggling multiple currencies or worrying about fluctuating exchange rates, travelers can rely on a single, powerful solution that brings convenience and control to every transaction.

Traveling overseas often involves unexpected expenses, complicated conversions, and hidden banking charges. That’s where the HDFC ForexPlus Card truly stands out. By allowing users to preload funds in multiple currencies and use them just like a debit or credit card, it eliminates the need for carrying large sums of cash and reduces the risk of loss or theft.

Advertisements

Moreover, it provides transparent spending management, letting you monitor balances and transactions in real time through online banking or the mobile app.

Another key advantage is its ability to lock exchange rates at the time of loading. This feature helps protect travelers from currency fluctuations that can otherwise make trips more expensive than planned. As global travel rebounds after years of restrictions, financial predictability has become a priority, and the HDFC ForexPlus Card answers that need perfectly.

What Is the HDFC ForexPlus Card?

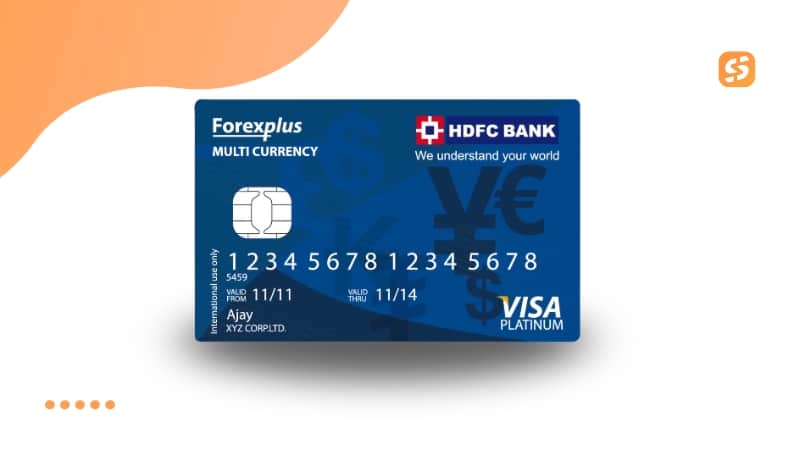

The HDFC ForexPlus Card is a prepaid foreign currency card that helps travelers manage their expenses abroad safely and efficiently. By allowing users to load multiple currencies in advance, it eliminates the need to carry cash and protects against exchange rate fluctuations.

Once loaded, the card can be used for shopping, dining, hotel bookings, or ATM withdrawals just like a regular debit or credit card, but with the added advantage of fixed exchange rates and real-time spending control.

Advertisements

Furthermore, the HDFC ForexPlus Card offers multi-currency flexibility, making it ideal for travelers visiting several countries during the same trip. Equipped with EMV chip and PIN protection, it ensures high security for all transactions.

If the card is lost or stolen, users can instantly block it and even request emergency cash assistance while abroad. Online reloading and balance tracking add convenience, allowing complete control from anywhere in the world.

Unlike a traditional Credit Card with Rewards India users typically carry, the ForexPlus Card provides direct financial benefits by avoiding heavy foreign transaction fees and unpredictable currency conversions.

It combines the best aspects of safety, convenience, and budgeting discipline, becoming a complete travel finance solution. For students, professionals, and frequent flyers alike, the HDFC ForexPlus Card is the smarter, more secure way to manage money internationally.

Main Benefits of the HDFC ForexPlus Card

1 – Multi-Currency Flexibility

One of the biggest advantages of the HDFC ForexPlus Card is its ability to store multiple currencies in one card. Travelers can load up to twenty-plus different currencies, switching seamlessly between them depending on their destination. This eliminates the need for multiple currency exchanges and reduces conversion costs.

2 – Locked-In Exchange Rates

When you load your HDFC ForexPlus Card, the exchange rate is locked at that moment. This means you are protected from future currency fluctuations and can plan your expenses more accurately. For travelers who value financial control, this is a significant advantage.

3 – Safe and Secure Transactions

The card uses EMV chip and PIN technology for enhanced protection against fraud. If the card is lost or stolen, it can be blocked instantly through online banking or mobile app. You can even request a replacement card or emergency cash assistance while abroad.

4 – Global Acceptance

Whether you’re paying for a hotel in London, withdrawing yen in Tokyo, or shopping in Dubai, the HDFC ForexPlus Card works almost anywhere. It’s accepted at all Visa or Mastercard merchant locations, depending on the card variant you choose.

5. Contactless Payments HDFC ForexPlus Card

With contactless functionality, you can simply tap your card to pay small bills without inserting it into a terminal. This makes transactions faster and more hygienic — a feature particularly useful during travel.

6 – Online Management

You can check your balance, reload funds, or review transactions online anytime. The real-time portal allows full transparency and control, ensuring you always know how much you’ve spent.

How to Apply for the HDFC ForexPlus Card

Applying for the HDFC ForexPlus Card is quick and straightforward. You don’t necessarily need to be an existing HDFC customer to apply.

Here’s a simplified process:

- Choose your card type: Standard, Regalia, Student, or Multi-Currency.

- Gather documents: Passport copy, PAN card, address proof, visa, and flight tickets.

- Visit an HDFC branch or authorized partner: Fill out the application form.

- Load your preferred currency: The rate will be locked once loaded.

- Activate and use your card: After activation, you’re ready to spend abroad.

The process typically takes a few hours, and you can start using your card immediately after loading funds.

How to Use the HDFC ForexPlus Card Abroad

Once loaded, using the HDFC ForexPlus Card is as simple as using any debit or credit card.

- At stores: Insert or tap your card and pay in the local currency.

- Online shopping: Use it for payments on international websites that accept foreign cards.

- At ATMs: Withdraw cash abroad in local currency whenever needed.

Important Tip:

Always choose to pay in the local currency instead of your home currency to avoid unnecessary conversion fees. This ensures you get the best possible rate locked during loading.

Pros and Cons of the HDFC ForexPlus Card

Pros

- Can hold multiple currencies on one card.

- Offers fixed exchange rates at the time of loading.

- High level of security with chip & PIN and online control.

- Global acceptance and convenience.

- Contactless payments for quick transactions.

- Emergency cash assistance and easy reloading.

Cons

- Some fees apply for issuance and withdrawals.

- Unused balance may sit idle if you don’t travel often.

- Exchange rates, while locked, may differ slightly from market rates.

Despite minor downsides, most users find that the convenience and safety far outweigh the costs, especially for frequent travelers or those visiting multiple destinations.

Tips to Get the Most Out of Your HDFC ForexPlus Card

To maximize your savings and convenience:

- Load multiple currencies before you travel to avoid conversion fees later.

- Track your spending using HDFC’s online portal to stay within budget.

- Reload smartly reload when the currency rate is favorable.

- Avoid Dynamic Currency Conversion (DCC) at foreign stores.

- Keep emergency contact details handy for blocking the card if needed.

- Utilize offers and promotions HDFC frequently provides cashback or reward programs.

By following these strategies, your HDFC ForexPlus Card can become your most efficient travel companion.

Final Thoughts

In summary, the HDFC ForexPlus Card is a secure and convenient prepaid travel solution that simplifies how Indian travelers manage their money abroad. With the ability to load multiple currencies and lock exchange rates, it eliminates the uncertainty of fluctuating forex markets and reduces dependence on cash.

Whether you’re traveling for leisure, studies, or work, it offers global acceptance and real-time expense control, making it one of the most trusted financial tools for international trips.

Beyond convenience, the HDFC ForexPlus Card ensures top-tier security with EMV chip and PIN protection, as well as the option to instantly block or reload the card online.

Unlike a traditional Credit Card with Rewards India users might prefer, the ForexPlus Card focuses on cost efficiency, transparency, and budgeting discipline, helping you save money while maintaining total control of your travel expenses.

Ultimately, this card is more than a payment method; it’s a travel companion designed for the modern world. Offering 24/7 accessibility, global usability, and long-term reusability, it’s ideal for anyone seeking comfort, safety, and financial flexibility while abroad. To explore its benefits or apply, visit the official website.