Advertisements

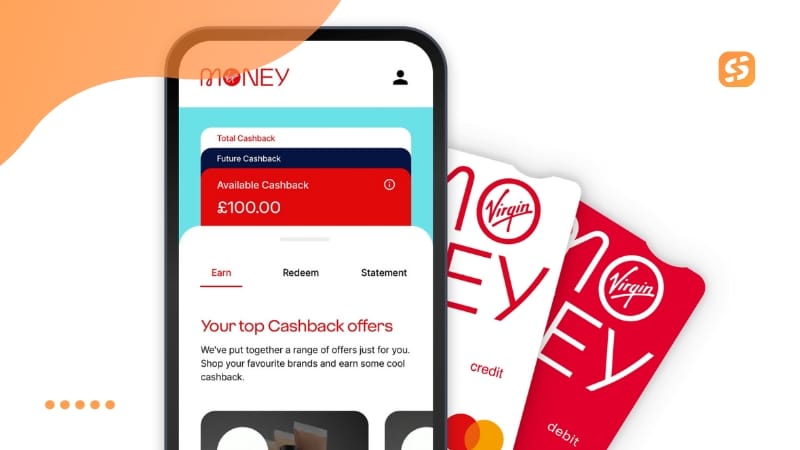

Are you thinking of applying for the Virgin Money credit card cashback UK, but still have doubts if this is really the right credit card for your current life moment?

To clear up all your doubts and decide whether or not to apply for the Virgin Money credit card cashback UK, you will need a complete analysis that includes the card’s advantages and the fees charged.

In this article, that’s what you’ll find. A realistic analysis of the Virgin Money credit card cashback UK options. We will examine the interest rates, the foreign exchange fee waiver rules, the earning limits, and how the app will help you achieve good financial results. Let’s go!

Advantages of the Virgin Money credit card cashback UK

The Everyday Cashback card is central for those seeking simplicity and financial return without bureaucracy. Let’s look at everything you’ll get with it.

Advertisements

1. Low Fees

Financially, it stands out for not charging an annual fee, which eliminates the fixed maintenance cost.

The representative Annual Percentage Rate (APR) is 27.9% variable, based on an assumed credit limit of £1,200.

Although this rate may seem high for those who usually carry a debt balance, it is irrelevant for those who pay the bill in full every month.

Furthermore, the card frequently offers promotional windows with 0% interest on purchases and balance transfers, subject to customer eligibility at the time of application.

2. Cashback on all purchases

The rewards mechanism of this Virgin Money credit card cashback UK was designed to create an immediate usage habit.

In the first 90 days after account opening, you receive an accelerated rate of 1% return on all eligible purchases.

After this initial period, the rate reverts to 0.25%.

Moreover, it may seem a modest percentage at first glance, but in the current scenario of interchange fees limited to 0.3%, it is a competitive offer.

To extract the maximum value from this structure, the intelligent consumer should plan large acquisitions, such as furniture or holiday expenses, for these first three months.

3. Frictionless Redemption

Another point worth highlighting is Frictionless Redemption.

Unlike archaic systems where you need to log into a portal and request the credit, the value earned through the base rate is automatically deducted from the monthly outstanding balance.

This feature reduces the customer’s burden and functions as a direct discount on the bill.

The card imposes an earning limit of £15 per month for this base rate.

Mathematically, to reach this ceiling at the standard rate of 0.25%, it would be necessary to spend £6,000 in a single month.

4. Global Fee Waiver

Most card issuers in the United Kingdom charge a fee known as the Non-Sterling Transaction Fee, which ranges between 2.75% and 2.99% on any purchase made outside the country.

To illustrate the financial impact of this feature, consider a holiday trip to the United States with total expenses of £2,000. Using a common card, you would pay about £60 just in exchange fees.

With this Virgin card, the saving is direct and surpasses the value that would be earned in points on most competing cards.

In addition, Virgin Money allows the extension of these benefits to additional cards for spouses or family members at no extra cost.

Spending by additional cardholders contributes to the main account’s total cashback. Allowing you to concentrate your expenses for a higher return.

Other Virgin Money Card Options

Virgin Atlantic Reward

For those who prefer miles instead of direct cash, Virgin offers the free Atlantic Reward card.

Although it is not focused on liquid cashback, it competes for the attention of the same consumer.

This card generates 0.75 Virgin Points for every £1 spent on daily purchases. Assuming a conservative valuation of 1p per point when used for flights, the effective return is 0.75%, which surpasses the base rate of 0.25% of the cashback card.

Furthermore, the accumulation rate doubles to 1.5 points on direct spending with Virgin Atlantic or Virgin Holidays, encouraging vertical loyalty within the group.

One difference compared to the Everyday card is the exchange fee policy.

The Virgin Atlantic Reward card offers an FX fee waiver only on transactions in Euros, Swedish Kronor, and Romanian Lei within the European Economic Area (EEA). Spending in Switzerland, Turkey, or the United States incurs the standard 2.99% fee.

Therefore, for travel outside Europe, the cashback card has the advantage. The main benefit here is the Reward Voucher, unlocked by spending £20,000 in one year, which allows for cabin upgrades or companion tickets. Depending on the member’s status in the Flying Club.

Virgin Atlantic Reward+

The Virgin Money Atlantic Reward+ paid version, with an annual fee of £160, is for those who have high expenses and travel a lot.

The accumulation rate increases to 1.5 Virgin Points per £1 on general spending and 3 points on Virgin spending.

The break-even point to justify the annual fee occurs with an annual spend of approximately £15,000, where the difference in accumulated points covers the cost of the card.

In addition, the threshold for earning the reward voucher drops from £20,000 to £10,000, making the benefit much more accessible to the upper middle class.

Comparison of Virgin Money Cards

| Feature | Everyday Cashback | Virgin Atlantic Reward (Free) | Virgin Atlantic Reward+ (Paid) | Balance Transfer / All Round |

| Annual Fee | £0 | £0 | £160 | £0 |

| Representative APR | 27.9% (Var.) | 26.9% (Var.) | 69.7% (Var.) | 27.9% – 29.9% (Var.) |

| FX Fee (Europe EEA) | 0% | 0% | 0% | 2.99% (Standard) |

| FX Fee (Global) | 0% | 2.99% | 2.99% | 2.99% |

| Balance Transfer | Not focused 0% | Not focused 0% | Not focused 0% | 0% for up to 34 months |

| Cash Advance | 5% (Min £5) | 5% (Min £5) | 5% (Min £5) | 5% (Min £5) |

Conclusion

Choosing a card in the Virgin Money portfolio requires a cool-headed analysis of your spending behavior.

The Virgin Money credit card cashback UK in the Everyday modality consolidates itself as the superior tool for the financial optimizer who values liquidity and travels outside Europe.

The combination of a global FX fee waiver with a fee-free cashback program offers a mathematical value that is hard to beat in the current market.

On the other hand, if your focus is to accumulate travel experiences and you spend over £10,000 annually on the card, the Virgin Atlantic options offer a higher perceived return through the vouchers.

However, for most users seeking simplicity and protection against abusive fees abroad, the Everyday Cashback wins for its versatility.

Think the cashback offered is too low? Then check out other options where you’ll get more money back. Discover the best credit cards with cashback UK now.

Other cards worth checking:

See other cards with similar benefits to what you’re viewing.