Advertisements

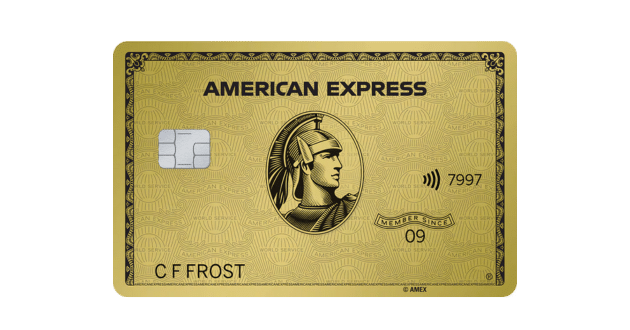

The American Express Preferred Rewards Gold Credit Card is one of the most attractive options for those who seek an elevated financial experience with exclusive benefits.

This card is particularly appealing to frequent travelers, dining enthusiasts, and individuals who appreciate rewards on everyday spending. With the American Express Preferred Rewards Gold Credit Card, cardholders gain access to Membership Rewards points, premium travel perks, and dining privileges.

Whether you want to earn points for flights, enjoy airport lounge access, or benefit from statement credits on travel expenses, this card delivers exceptional value.

If you’re considering applying for this prestigious card, this guide will walk you through the process, eligibility requirements, and key factors to consider before submitting your application.

Advertisements

Eligibility Requirements

Before applying for the American Express Preferred Rewards Gold Credit Card, you must meet certain criteria. While American Express does not publicly disclose all its approval requirements, here are the essential eligibility factors:

- Age Requirement: Applicants must be at least 18 years old (or the legal age in their country of residence).

- Credit Score: A good to excellent credit score (typically 700 or above) increases your chances of approval.

- Income Criteria: While there is no official minimum income requirement, a stable income is essential to qualify.

- Residency: You must be a resident of the country where you are applying for the card.

- Banking and Credit History: A clean credit history with no recent bankruptcies or delinquencies is crucial. / Having an existing relationship with American Express may improve approval odds.

Now that you know the requirements, let’s move on to the application process.

Step-by-Step Guide to Apply for the American Express Preferred Rewards Gold Credit Card

1 – Visit the Official Website

The simplest and most practical way to sign up is through the American Express website. Visit the official credit card section and locate the American Express Preferred Rewards Gold Credit Card.

2 – Click on “Apply Now”

Once you have reviewed the benefits and fees, click the “Apply Now” button to begin the application process.

3 – Fill Out the Application Form

You will be required to provide the following details:

- Personal Information: Full name, date of birth, and Social Security Number (if applicable).

- Contact Information: Email address, phone number, and residential address.

- Employment Details: Your current job title, employer, and annual income.

- Financial Information: Monthly rent/mortgage payments and other financial obligations.

4 – Consent to a Credit Check

American Express will perform a hard inquiry on your credit report to assess your eligibility. This may temporarily lower your credit score, so be sure you meet the requirements before applying.

5 – Submit Your Application

After verifying all the details, submit your application. You will receive an instant decision in many cases, but sometimes, American Express may take a few days to process your request.

What Happens After You Apply American Express Preferred Rewards Gold Credit Card?

Once you submit your application, American Express will review your creditworthiness and financial history. Here’s what to expect:

- Instant Approval: If you meet all the criteria, you may get immediate approval and receive your card within 7-10 business days.

- Further Review: In some cases, American Express may require additional verification. You might be asked to provide income proof or bank statements.

- Denial: If your application is denied, you will receive a letter explaining the reason. You can work on improving your credit score and reapply in the future.

Tips to Increase Your Chances of Approval

If you want to maximize your chances of getting approved for the American Express Preferred Rewards Gold Card, follow these tips:

- Check Your Credit Score: Ensure your credit score is at least 700 before applying.

- Pay Off Existing Debts: Reduce your outstanding debts to improve your debt-to-income ratio.

- Ensure Stable Income: A higher, stable income increases your chances of approval.

- Avoid Multiple Applications: Too many credit applications within a short period can hurt your score.

- Use Other American Express Products: Having a history with American Express can boost approval chances.

8 FAQs American Express Preferred Rewards Gold Credit Card

1. Can I apply for the American Express Preferred Rewards Gold Credit Card with a fair credit score?

While possible, approval is unlikely with a fair credit score (below 700). It’s best to improve your credit score before applying.

2. How long does it take to receive the card after approval?

Once approved, your card typically arrives within 7-10 business days.

3. Is there an annual fee for the American Express Preferred Rewards Gold Card?

Yes, but American Express often waives the fee for the first year as a promotional offer.

4. Can I add an authorized user to my account?

Yes, you can add authorized users, allowing them to benefit from the card’s perks while you remain responsible for the account balance.

5. Does the card come with travel insurance?

Yes, the card offers travel-related insurance, including baggage delay and trip cancellation coverage.

6. Can I apply for this card if I already have an American Express credit card?

Yes, but approval depends on your credit profile and existing credit limit.

7. What should I do if my application is denied?

If denied, review the rejection reason, work on improving your credit score, and reapply after a few months.

8. Are there any restrictions on earning Membership Rewards points?

No, but certain transactions such as cash advances, balance transfers, and fees do not earn points.

Conclusion for American Express Preferred Rewards Gold Credit Card

The American Express Preferred Rewards Gold Credit Card is a premium financial tool designed for individuals who want to enjoy an elevated lifestyle. With its extensive reward system, travel benefits, and dining perks, it caters to those who seek both luxury and practicality.

By understanding the eligibility requirements, following the step-by-step application process, and preparing in advance, you can significantly improve your chances of approval.

If you frequently travel, dine out, or make substantial purchases, this card can enhance your financial experience and help you maximize your spending power.

If you meet the qualifications and want to enjoy its exceptional benefits, apply today and take advantage of what this prestigious card has to offer!

You will go to the official website!

More options you might like:

See other cards with similar benefits to what you’re viewing.